How much does a credit score really matter?

I often have clients who raise concerns about how bankruptcy will affect their credit score. First off, your credit score is completely irrelevant unless you are trying to obtain credit, finance a vehicle, or purchase a home. I rarely see cases where my clients have sought to file a bankruptcy before their credit has already taken a hit with missed payments, closed accounts, and other derogatory marks. In general, if you don’t already have bad credit and are considering filing bankruptcy, you will want to stop paying your debts immediately and your credit will slowly drop from there until you file your case. Most people can rest assured that filing bankruptcy was a financially smart decision and will put them in a better situation to move on with their lives, buy a home, car, etc.

How does a bankruptcy affect your credit score?

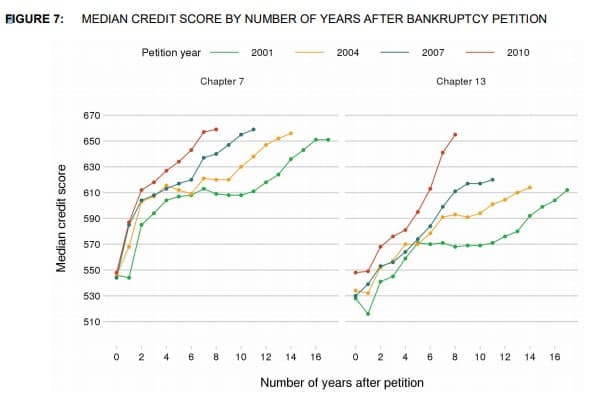

One of the most common myths of bankruptcy is that your credit is completely destroyed for 7 to 10 years. However, most people will actually see a huge jump in their credit score within a short period of time, which can often start within a month or two of filing their bankruptcy and while the case is pending. It may seem counter-intuitive that a recent bankruptcy will actually help your credit score, but there are two primary factors at play here: 1) receiving a discharge of a substantial amount of debt will make it easier for you to pay new debt; 2) the fact that you can only file a Chapter 7 once every eight years means that a creditor will potentially have several years to collect against you without needing to worry that you will turn around and file bankruptcy on the debt.

Credit scores also tend to rise during a Chapter 13 bankruptcy, although, as noted on the graph below, the recovery takes longer. This is likely due to the fact that Chapter 13 cases have a high failure rate which usually decreases the longer someone has been in the case.

My clients’ experiences

I like to check in with my clients after their bankruptcy cases have closed to see how their lives have been impacted by the bankruptcy and how it has affected their credit. What I’ve heard back from many of those clients is that the initial impact was minimal and that recovery was quick and easy. It is important to stay on top of your financial situation and follow a few easy steps to rebuilding your credit.

Related posts:

- Rebuilding Credit After A Bankruptcy

Check your credit report after your case is closed There’s two good sources to get... - How to Handle Financed Vehicles in a Chapter 7 Bankruptcy

Reaffirmation, Ride-Through, Redemption, and Surrender These options only apply to vehicles that are financed or... - Mortgage and Renter’s Relief Under the 2020 CARES Act

The $2.3 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act provides mortgage and foreclosure...